INTRODUCTION

The healthcare and medical device sectors have grown significantly in the last decade. There is a huge gap in the current demand and supply of medical devices in India and this provides a significant opportunity for manufacturing devices in India.

At present, many medical device manufacturers (domestic and international) are chasing this massive under penetration of medical devices in India as a significant growth opportunity.

MARKET SIZE

In India is among the top 20 markets for medical devices worldwide. The market is expected to increase at a 37% CAGR to reach US$ 50 billion in 2025, from Rs. 75,611 crore (US$ 10.36 billion) in 2020. The medical devices sector in India comprises large multinationals and small and midsized companies.

The Government of India (GOI) has commenced various initiatives to strengthen the medical devices sector, with emphasis on research and development (R&D) and 100% FDI for medical devices to boost the market. FDI inflow in the medical and surgical appliances sector stood at US$ 2.35 billion between April 2000-December 2021.

Between 2020 and 2025, diagnostic imaging is likely to expand at a CAGR of 13.5%.

India's wearable market grew 93.8% YoY in the July–September 2021 quarter, shipping 23.8 million units. Noise maintained its lead for the sixth straight quarter with a 26% market share in the third quarter, followed by Boat (23.1%), Fire-Boltt (15.3%), Realme (7.3%) and Amazfit (4.8%).

EXPORT SCENARIO

India has a 75-80% import dependency on medical devices. Exports stood at (US$ 2.51 billion) in 2019-20 and are expected to rise at to US$ 10 billion by 2025.

To increase export of medical devices in the country, the Indian Ministry of Health and Family Welfare (MOHFW) and Central Drugs Standard Control Organisation (CDSCO) implemented the following initiatives: re-examination and implementation of Schedule MIII (a draft guidance on good manufacturing practices and facility requirements), system for export labelling, clinical evaluation and adverse reporting clarification, state licensing authority to extend free sales certificate validity from 2 years to 5 years to allow exports, create a list of manufacturers with export licensing for easy access by regulatory authorities worldwide.

The Medical Devices Virtual Expo 2021 showcased Indian products and enabled direct interaction between Indian suppliers and buyers/importers from participating countries. Also, 300 foreign buyers from the healthcare sector participated in this event.

INVESTMENTS

TTo further incentivise investments in manufacturing medical devices, in May 2020, the government announced incentivisation plans of at least Rs. 3,420 crore (US$ 4.9 billion) over a period of five years, and these funds will be offered to manufacturers only if they invest in set-ups to manufacture key medical devices

Some major investments and developments in medical devices are as follows:

- In November 2021, Cipla launched ‘Spirofy’, India's first pneumotach based portable, wireless spirometer.

- In November 2021, Serene Envirotech Pvt. Ltd., a Mumbai-based start-up, launched a portable molecular hydrogen generating machine, ‘udazH’, for personal use. The molecular hydrogen inhaler comes with a dual-use technology that lets two users simultaneously use the machine.

- In October 2021, Microtek announced plans to consolidate its position by expanding their medical devices portfolio. The company forayed into the burgeoning Indian healthcare market by manufacturing products including oxygen concentrators, blood pressure monitors, oximeters, and thermometers, both digital and infrared.

- In October 2021, Innovation Imaging Technologies Pvt. Ltd. (IITPL) established a ‘state-of-the-art’ facility in Bengaluru to manufacture 240 catheterisation laboratories in the next 12 months. Through this initiative, the company aims to strengthen the infrastructure to treat cardio-vascular diseases in the country.

- In October 2021, the HMD achieved a milestone by supplying 500 million 0.5 ml AD syringes to the government to accelerate the vaccination drive and contribute to India’s Atmanirbhar (self-reliance) mission.

- The company further plans to achieve annual capacity of 3.5 billion syringes by March 2022.

- In September 2021, Sahajanand Medical Tech filed its Draft Red Herring Prospectus (DRHP) with SEBI for its Initial Public Offering (IPO) worth Rs. 1,500 crore (US$ 202.31 million).

- In September 2021, Medtronic India Private Limited collaborated with Stasis Health Private Limited to boost patient monitoring in India.

- In September 2021, Siemens Healthineers announced that molecular testing kits will be manufactured in its Vadodara, Gujarat, unit.

- In September 2021, Siemens Healthineers extended its collaboration with SyntheticMR, with a new license agreement for distribution of the company’s (SyntheticMR) products.

- Professor Michael Lerch of the University of Wollongong (UOW) has been given a US$179,000 Australia-India Council grant to conduct pre-clinical testing on a novel medical device for neurosurgery by the Department of Foreign Affairs and Trade (DFAT).

- In June 2021, Skanray Technologies filed its draft red herring prospectus (DRHP) with SEBI for its initial public offering (IPO) worth Rs. 400 crore (US$ 53.70 million). The IPO is expected to include sale of secondary share, wherein its promoters and Ascent Capital (an existing private equity investor) are expected to sell a part of their stake.

- By 2022, the Gautam Budh Nagar, Noida, is expected to have Northern India’s first medical tools and system manufacturing park. The park is likely to be developed in Sector 28 of the Yamuna Expressway Industrial Development Authority (YEIDA) Space by the Yamuna Expressway Authority. In March 2021, YEIDA is expected to introduce a mission scheme worth ~Rs. 5,000 crore (US$ 685.35 million), of which Rs. 100 crore (US$ 13.71 million) is likely to be funded by the central authorities.

- In February 2021, Punjab’s Industry and Commerce Minister Mr. Sunder Sham Arora announced that a park for medical devices was proposed in Rajpura, Punjab, across an area of 210 acres, with an estimated project cost of ~ Rs. 180 crore (US$ 24.67 million).

- In January 2021, Tamil Nadu government proposed to build a medical devices park (spanning 350 acres) near Oragadam in Kancheepuram district. The proposed cost for developing this project is Rs 430 crore (US$ 58.92 million).

- In March 2021, Transasia Bio-Medical Ltd., a Mumbai-based in-vitro diagnostic company, announced plans to invest Rs. 150 crore (US$ 21 million) to set up a manufacturing unit at the Medical Devices Park in Sultanpur, Telangana. The company plans to manufacture state-of-the-art high-technology analysers in the unit to address biochemistry, immunology, hematology, molecular testing in addition to COVID-19, HIV, dengue, and TB testing for domestic and export markets.

- Japan-headquartered Omron Healthcare, which established its Indian arm in 2010, is drawing growth plans for India that may include setting up a manufacturing unit in India and expanding its retail footprint. By the end of 2021, the company plans to have 10 retail outlets in India and plans to create a centre in Warangal as part of its expansion into Southern India, where it anticipates a potential contribution of 40% of its sales in FY 2020. The company expects a Rs. 220 crore (US$ 30 million) turnover in India during that period.

GOVERNMENT INITIATIVES

- In the Union Budget 2022-23, Rs. 86,200 crores (US$ 11.3 billion) was allocated as a budget for the pharmaceutical and healthcare sector.

- In November 2021, Indian Council of Medical Research (ICMR) collaborated with Indian Institutes of Technology (IITs) to establish ‘ICMR at IITs’ by setting up Centres of Excellence (CoE) for Make-in-India product development and commercialisation in the medical devices and diagnostics space. In October 2021, the government announced plan to draft a new drugs, cosmetics and medical devices bill to increase the acceptability of Indian medical devices in the global market.

- In October 2021, the government announced plan to draft a new drugs, cosmetics and medical devices bill to increase the acceptability of Indian medical devices in the global market.

- In October 2021, the government announced that 13 companies have been approved under the PLI scheme for medical devices, which are expected to boost domestic manufacturing in the country.

- The Government of India has recognised medical devices as a sunrise sector under the ‘Make in India’ campaign in 2014.

- In September 2021, the government sanctioned a proposal worth Rs. 5,000 crore (US$ 674.36 million) to build a medical devices park in Himachal Pradesh’s industrial township, Nalagarh, in the Solan district.

- In September 2021, the government approved a medical devices park in Oragadam (Tamil Nadu) that is expected to attract an estimated investment of Rs. 3,500 crore (US$ 472.05 million) and offer direct and indirect employment to ~10,000 people.

- In July 2021, the government announced to build medical park in Uttar Pradesh, which is expected to generate an estimated Rs. 500 crore (US$ 67.13 million) business in the state.

- In June 2021, the Quality Council of India (QCI) and the Association of Indian Manufacturers of Medical Devices (AiMeD) launched the Indian Certification of Medical Devices (ICMED) 13485 Plus scheme to undertake verification of the quality, safety and efficacy of medical devices

- To boost domestic manufacturing of medical devices and attract huge investments in India, the department of pharmaceuticals launched a PLI scheme for domestic manufacturing of medical devices, with a total outlay of funds worth Rs.3,420 crore (US$ 468.78 million) for the period FY21-FY28.

- In March 2021, the PLI Scheme for pharmaceuticals worth Rs. 15,000 crores (US$ 1.96 billion) was launched. This scheme aims to enhance India’s manufacturing capabilities by increasing investment and production in the pharmaceutical and medical devices sectors and contribute to contribute to the availability of a wider range of affordable medicines for consumers.

- On March 25, 2021, the Department of Pharmaceuticals (DoP) released a revised notice on the Public Procurement Order (PPO), incorporating 19 medical devices in the revised guidelines of the PPO, which is expected to improve domestic medical devices manufacturing (and strengthen ‘Make in India’) and reduce import bills by ~Rs. 4,000 crore (US$ 538.62 million).

- In order to expedite the clearance of medical devices such as nebulisers, oxygen concentrators and oxygen canisters in April 2021, the government made it easier to import critical medical devices by easing the requirements for clearance under the Legal Metrology Act (Packaging Rules 2011).

- The government also approved applications for nine eligible projects that are expected to lead to a total committed investment of ~Rs. 729.63 crore (US$ 100.01 million) by the companies (e.g., Siemens Healthcare Private Limited, Allengers Medical Systems Limited (AMSL), Allengers OEM Private Limited (AOPL), Wipro GE Healthcare Private Limited, Nipro India Corporation Private Limited, Sahajanand Medical Technologies Private Limited, Innvolution Healthcare Private Limited, Integris Health Private Limited) and generate ~2,304 jobs.

ACHIEVEMENTS IN THE SECTOR

In India, medical device manufacturing is costly because it requires high investments in scientific facilities. To combat this cost, the Government of Andhra Pradesh is establishing the Andhra Pradesh MedTech Zone (APMTZ), which will house all capital-intensive scientific facilities, laboratories, etc., and will be leased to manufacturers in Vishakhapatnam. This initiative will help decrease the cost of good-quality products.

ROAD AHEAD

Policy makers in India will need to set out an action plan to reduce the country’s dependency on medical devices/technology imports. At present, NITI Aayog is reportedly drawing up a strategic road map for medical devices similar to the incentive package that gives sizable capital subsidies for the electronics business, which helps boost local production of cell phones in the country.

Medical device companies should develop India as a manufacturing hub for domestic and international markets, undertake India-based innovation in combination with indigenous manufacturing, collaborate across the Make in India and Innovate in India schemes, and produce Low to Medium technology products to cater to the underpenetrated domestic markets.

References: Government Websites, Press Releases, Media Reports, Deloitte Report

Note: Conversion rate used for November 2021 is Rs. 1 = US$ 0.01336

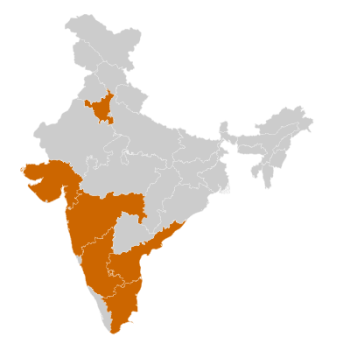

Medical Devices Clusters

- Gujarat

- Maharashtra

- Karnataka

- Haryana

- Andhra Pradesh

- Tamil Nadu

Industry Contacts

- Medical Technology Association of India

- Association of Medical Device industry (AIMED)

- Association of Diagnostics Manufacturers of India