INTRODUCTION

India is the largest provider of generic drugs globally. Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all medicine in the UK. Globally, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value. The domestic pharmaceutical industry includes a network of 3,000 drug companies and ~10,500 manufacturing units.

India enjoys an important position in the global pharmaceuticals sector. The country also has a large pool of scientists and engineers with the potential to steer the industry ahead to greater heights. Presently, over 80% of the antiretroviral drugs used globally to combat AIDS (Acquired Immune Deficiency Syndrome) are supplied by Indian pharmaceutical firms.

MARKET SIZE

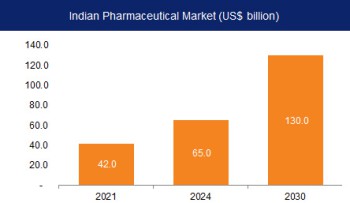

According to the Indian Economic Survey 2021, the domestic market is expected to grow 3x in the next decade. India's domestic pharmaceutical market is at US$ 42 billion in 2021 and likely to reach US$ 65 billion by 2024 and further expand to reach ~US$ 120-130 billion by 2030.

India's biotechnology industry comprises biopharmaceuticals, bio-services, bio-agriculture, bio-industry, and bioinformatics. The Indian biotechnology industry was valued at US$ 70.2 billion in 2020 and is expected to reach US$ 150 billion by 2025.

India's medical devices market stood at US$ 10.36 billion in FY20. The market is expected to increase at a CAGR of 37% from 2020 to 2025 to reach US$ 50 billion.

As of August 2021, CARE Ratings expect India's pharmaceutical business to develop at an annual rate of ~11% over the next two years to reach more than US$ 60 billion in value.

In the global pharmaceuticals sector, India is a significant and rising player. India is the world's largest supplier of generic medications, accounting for 20% of the worldwide supply by volume and supplying about 60% of the global vaccination demand. The Indian pharmaceutical sector is worth US$ 42 billion and ranks 3rd in terms of volume and 13th in terms of value worldwide.

In August 2021, the Indian pharmaceutical market increased at 17.7% annually, up from 13.7% in July 2020. According to India Ratings & Research, the Indian pharmaceutical market revenue is expected to be over 12% Y-o-Y in FY22.

EXPORTS

Indian pharmaceutical exports stood at US$ 24.44 billion in FY21 and US$ 22.21 billion in FY22 (until February 2022). India is the 12th largest exporter of medical goods in the world. The country's pharmaceutical sector contributes 6.6% to the total merchandise exports. As of May 2021, India supplied a total of 586.4 lakh COVID-19 vaccines, comprising grants (81.3 lakh), commercial exports (339.7 lakh) and exports under the COVAX platform (165.5 lakh), to 71 countries. Indian drugs are exported to more than 200 countries in the world, with the US being the key market. Generic drugs account for 20% of the global export in terms of volume, making the country the largest provider of generic medicines globally. India's drugs and pharmaceuticals exports stood at US$ 3.76 billion between April 2021 and May 2021. The Indian drugs and pharmaceuticals sector received cumulative FDIs worth US$ 19.19 billion between April 2000-December 2021. The foreign direct investment (FDI) inflows in the Indian drugs and pharmaceuticals sector reached US$ 1.206 billion between April-December 2021. In FY21, North America was the largest market for India's pharma exports with a 34% share and exports to the U.S., Canada, and Mexico recorded a growth of 12.6%, 30% and 21.4%, respectively.

INVESTMENTS AND RECENT DEVELOPMENTS

The Union Cabinet has given its nod for the amendment of the existing Foreign Direct Investment (FDI) policy in the pharmaceutical sector in order to allow FDI up to 100% under the automatic route for manufacturing of medical devices subject to certain conditions.

The Indian drugs and pharmaceuticals sector received cumulative FDIs worth US$ 19.19 billion between April 2000-December 2021.

Some of the recent developments/investments in the Indian pharmaceutical sector are as follows:

- In March 2022, Themis Medicare Ltd. (Themis), announced the approval of its antiviral drug VIRALEX by the Drug Controller General of India (DCGI).

- In November 2021, US-based Akston Biosciences announced that it would start the clinical trial of its second-generation COVID-19 vaccine 'AKS-452' in India soon.

- In October 2021, AstraZeneca India launched a Clinical Data and Insights (CDI) division to further strengthen its global presence and manage data-related aspects of its clinical trials.

- In September 2021, the Indian government contributed US$ 4 billion to the pharmaceutical and medical industries.

- In August 2021, Glenmark collaborated with SaNOtize to introduce spray for COVID-19 treatment in India and other Asian markets.

- In August 2021, Uniza Group, an Ahmedabad-based pharmaceutical firm, signed an agreement with Lysulin Inc. (an US-based firm) to introduce Lysulin, a nutritional product for Indian consumers.

- In August 2021, Alkem Laboratories introduced Famotidine and Ibuprofen tablets to treat osteoarthritis and rheumatoid arthritis symptoms in the US.

- In July 2021, Generic Health (an Australia-based subsidiary of Lupin Limited) signed an agreement with Southern Cross Pharma Pty Ltd. (SCP). Under this deal, Lupin will acquire 100% shares of SCP. The acquisition is expected to further strengthen Lupin’s foothold in Australia.

- In June 2021, Sun Pharmaceuticals acquired the patent license for Dapagliflozin from AstraZeneca. The company will be distributing and promoting the drug under the brand name 'Oxra'.

- In June 2021, Lupin Ltd. announced its intention to enter the digital healthcare space in India. It incorporated Lupin Digital Health Ltd., a wholly owned subsidiary, to provide a digital therapeutics platform for medical practitioners and patients in the country.

- In May 2021, Cipla launched a real-time COVID-19 detection kit ‘ViraGen’ that is based on multiplex polymerase chain reaction (PCR) technology.

- In May 2021, the Government of India invited R&D proposals on critical components and innovations in oxygen concentrators by June 15, 2021.

- In May 2021, Indian Immunologicals Ltd. (IIL) and Bharat Immunologicals and Biologicals Corporation (BIBCOL) inked technology transfer pacts with Bharat Biotech to develop the vaccine locally to boost India's vaccination drive. The two PSUs plan to start production of vaccines by September 2021.

- In May 2021, Eli Lilly & Company issued non-exclusive voluntary licenses to pharmaceutical companies—Cipla Ltd., Lupin Ltd., Natco Pharma & Sun Pharmaceutical Industries Ltd.—to produce and distribute Baricitinib, a drug for treating COVID-19.

- In April 2021, the CSIR-CMERI, Durgapur, indigenously developed the technology of Oxygen Enrichment Unit (OEU). The unit can deliver medical air in the range of ~15 litres per minute, with oxygen purity of >90%. It transferred the technology to MSMEs—Conquerent Control Systems Pvt. Ltd., A B Elasto Products Pvt. Ltd. and Automation Engineers, Mech Air Industries and Auto Malleable.

- In April 2021, National Pharmaceutical Pricing Authority (NPPA) fixed the price of 81 medicines including off-patent anti-diabetic drugs allowing due benefits of patent expiry to the patients.

- In February 2021, Aurobindo Pharma announced plans to procure solar power from two open access projects of NVNR Power and Infra in Hyderabad. The company will acquire 26% share capital in both companies with an US$ 1.5 million investment. The acquisition is expected to be completed by the end of March 2021.

- In February 2021, the Telangana government partnered with Cytiva to open a ‘Fast Trak’ lab to strengthen the biopharma industry of the state.

- In February 2021, Glenmark Pharmaceuticals Limited launched SUTIB, a generic version of Sunitinib oral capsules, for the treatment of kidney cancer in India.

- In February 2021, Natco Pharma launched Brivaracetam for the treatment of epilepsy in India.

- In February 2021, the Russian Ministry of Health allowed Glenmark Pharmaceuticals to market its novel fixed-dose combination nasal spray in Russia.

- In January 2021, the Central government announced to set up three bulk drug parks at a cost of Rs. 14,300 crore (US$ 1,957 million) to manufacture chemical compounds or active pharmaceutical ingredients (APIs) for medicines and reduce imports from China.

- PharmEasy received US$ 300 million in July 2021 from its existing investors after acquiring Thyrocare, the diagnostic firm. These funds will be utilised to continue Thyrocare's acquisition process. After the transaction is completed, the online pharmacy plans to float the company on the Indian Stock Exchange.

GOVERNMENT INITIATIVES

Some of the initiatives taken by the Government to promote the pharmaceutical sector in India are as follows:

- In March 2022, under the Strengthening of Pharmaceutical Industry (SPI) Scheme, a total financial outlay of Rs. 500 crore (US$ 665.5 million) for the period FY 21-22 to FY 25-26 were announced.

- India could restart deliveries of COVID-19 shots to the global vaccine-sharing platform COVAX in November-December 2021 for the first time since April 2021. The World Health Organization (WHO), which co-leads COVAX, has been pushing India to resume supplies for the programme, particularly after it sent ~4 million doses to neighbours and allies in October 2021.

- In November 2021, PM Mr. Narendra Modi inaugurated the first Global Innovation Summit of the pharmaceuticals sector. The summit will have 12 sessions and over 40 national and international speakers deliberating on a range of subjects including regulatory environment, funding for innovation, industry-academia collaboration and innovation infrastructure.

- In August 2021, Mr. Mansukh Mandaviya, Minister of Health and Family Welfare, announced that an additional number of pharmaceutical companies in India are expected to commence manufacturing of anti-coronavirus vaccines by October-November 2021. This move is expected to further boost the vaccination drive across the country.

- In June 2021, Ms. Nirmala Sitharaman, Minister of Finance and Corporate Affairs, announced an additional outlay of Rs. 197,000 crore (US$ 26,578.3 million) that will be utilised over five years for the pharmaceutical PLI scheme in 13 key sectors such as active pharmaceutical ingredients, drug intermediaries and key starting materials.

- As of August 31, 2021, the PLI scheme received a good response from the industry with a total of 278 applications. This is likely to benefit 55 manufacturers.

- To achieve self-reliance and minimise import dependency in the country's essential bulk drugs, the Department of Pharmaceuticals initiated a PLI scheme to promote domestic manufacturing by setting up greenfield plants with minimum domestic value addition in four separate 'Target Segments' with a cumulative outlay of Rs. 6,940 crore (US$ 951.27 million) from FY21 to FY30.

- In May 2021, under Atmanirbhar Bharat 3.0, Mission COVID Suraksha was announced by the Government of India to accelerate development and production of indigenous COVID vaccines. To augment the capacity of indigenous production of Covaxin under the mission, the Department of Biotechnology, Government of India, provided financial support in the form of a grant to vaccine manufacturing facilities for enhanced production capacities, which is expected to reach >10 crore doses per month by September 2021.

- In April 2021, the Union Government decided to streamline and fast-track the regulatory system for COVID-19 vaccines that have been approved for restricted use by the US FDA, EMA, UK MHRA, PMDA Japan or those listed in the WHO Emergency Use Listing (EUL). This decision is likely to facilitate quicker access to foreign vaccines by India and encourage imports.

- In February 2021, the Punjab government announced to establish three pharma parks in the state. Of these, a pharma park has been proposed at Bathinda, spread across ~1,300 acres area and project worth ~Rs. 1,800 crore (US$ 245.58 million). Another medical park worth Rs. 180 crore (US$ 24.56 million) has been proposed at Rajpura and the third project, a greenfield project, has been proposed at Wazirabad, Fatehgarh Sahib.

- Under Union Budget 2021-22, the Ministry of Health and Family Welfare has been allocated Rs. 73,932 crore (US$ 10.35 billion) and the Department of Health Research has been allocated Rs. 2,663 crore (US$ 365.68 billion). The government allocated Rs. 37,130 crore (US$ 5.10 billion) to the 'National Health Mission'. PM Aatmanirbhar Swasth Bharat Yojana was allocated Rs. 64,180 crore (US$ 8.80 billion) over six years. The Ministry of AYUSH was allocated Rs. 2,970 crore (US$ 407.84 million), up from Rs. 2,122 crore (US$ 291.39 million).

ROAD AHEAD

Medicine spending in India is projected to grow 9-12% over the next five years, leading India to become one of the top 10 countries in terms of medicine spending.

Going forward, better growth in domestic sales would also depend on the ability of companies to align their product portfolio towards chronic therapies for diseases such as cardiovascular, anti-diabetes, anti-depressants and anti-cancers, which are on the rise.

The Indian Government has taken many steps to reduce costs and bring down healthcare expenses. Speedy introduction of generic drugs into the market has remained in focus and is expected to benefit the Indian pharmaceutical companies. In addition, the thrust on rural health programmes, lifesaving drugs and preventive vaccines also augurs well for the pharmaceutical companies.

References: Consolidated FDI Policy, Press Information Bureau (PIB), Media Reports, Pharmaceuticals Export Promotion Council, AIOCD-AWACS, IQVIA

Disclaimer: This information has been collected through secondary research and IBEF is not responsible for any errors in the same

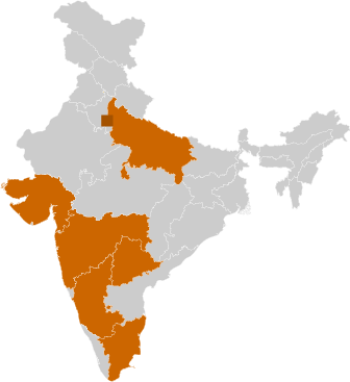

Major states for Pharmaceuticals

- Karnataka

- Maharashtra

- Gujarat

- Uttar Pradesh

- Delhi NCR

- Tamil Nadu

- Telangana

Industry Contacts

- The Indian Pharmaceutical Association

- Organisation of Pharmaceutical Producers of India

- Indian Drug Manufacturers' Association

- Bulk Drug Manufacturers Association