INTRODUCTION

The Indian Media and Entertainment (M&E) industry is a sunrise sector for the economy and is making significant strides. Proving its resilience to the world, Indian M&E industry is on the cusp of a strong phase of growth, backed by rising consumer demand and improving advertising revenue. According to a FICCI-EY report, the advertising to GDP ratio is expected to reach 0.4% by 2025 from 0.38% in 2019.

MARKET SIZE

As per BCG report, India’s M&E industry is expected to grow between US$ 55-70 billion by 2030.

India’s digital advertising industry is expected to grow to Rs. 23,673 crore (US$ 3.09 billion) in 2022 from Rs. 18,938 crore (US$ 2.47 billion) in 2021.

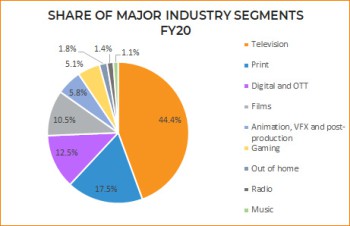

Television would account for 40% of the Indian media market in 2024, followed by print media (13%), digital advertising (12%), cinema (9%), and the OTT and gaming industries (8%).

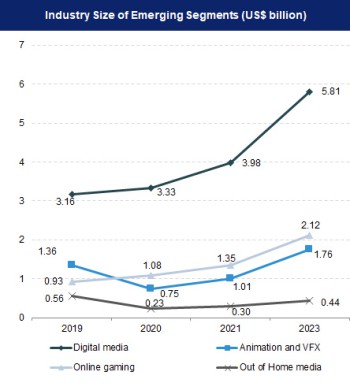

The market is projected to increase at a CAGR of 17% between 2020 and 2023.

Within the M&E sector, Animation, Visual Effects, Gaming and Comic (AVGC) sector is growing at a rate of ~29%, while the audio-visual sector and services is rising at the rate ~25%; is recognised as of one of the champion sectors by the Government of India. The AVGC sector is estimated to grow at ~9% to reach ~Rs. 3 lakh crore (US$ 43.93 billion) by 2024, stated Union Minister of Commerce & Industry, Consumer Affairs & Food & Public Distribution and Textiles, Mr. Piyush Goyal.

According to BCG, India’s SVOD subscriptions is expected to increase by 51% as compared to 2019 and is estimated to reach 90-100 million by 2022.

Advertising revenue in India is projected to reach Rs. 915 billion (US$ 12.98 billion) in 2023, from Rs. 596 billion (US$ 8.46 billion) in 2020.

India’s subscription revenue is projected to reach Rs. 940 billion (US$ 13.34 billion) in 2023, from Rs. 631 billion (US$ 8.95 billion) in 2020.

Key growth drivers included rising demand for content among users and affordable subscription packages.

The Indian mobile gaming market is growing at a pace in tandem with the global trend and is expected to reach US$ 7 billion in 2025. The online gaming market in India is projected to reach Rs. 155 billion (US$ 2.12 billion) by 2023, from Rs. 76 billion (US$ 1.08 billion) in 2020, due to rapid increase in consumption.

The music industry is expected to reach Rs. 23 billion (US$ 330 million) by 2023, from Rs. 15 billion (US$ 210 million) in 2020 at a CAGR of 15% between 2020 and 2023. According to a study conducted by Kantar and VTION, an audience measurement and analytics company, Gaana, the streaming service owned by Times Internet Ltd., had 30% market share, followed by JioSaavn (24%), Wynk Music (15%), Spotify (15%), Google Play Music (10%), and others (6%) in 2020.

Growth of the sector is attributable to the trend of platform such as YouTube that continues to offer recent and video content-linked music for free, which is expected to drive the paid OTT music sector reaching ~5 million end-users by 2023, generating revenue of ~Rs. 2 billion (US$ 27 million).

By 2025, the number of connected smart televisions are expected to reach ~40-50 million. 30% of the content viewed on these screens will be gaming, social media, short video and content items produced exclusively for this audience by television, print and radio brands. In the second quarter of 2021, smart TV shipments from India increased by 65% YoY, due to rising expansion activities adopted by original equipment manufacturers (OEMs) for their smart TV portfolios. By 2025, ~600-650 million Indians, will consume short-form videos, with active users spending up to 55 to 60 minutes per day.

According to the FICCI-EY media and entertainment industry survey, those who watch online videos through bundled packages (online video services bundled with mobile and broadband connections) will account for half of all online video viewers (399 million) by 2023, up from 284 million in 2020.

As of 2020, India registered ~803 million online video viewers, including streaming services and videos on free platforms such as YouTube. Mobile video viewers stood at 356 million in 2020, driven by rising number of users preferring video content over the last few years.

OTT video services market (video-on-demand and live) in India is likely to post a CAGR of 29.52% to reach US$ 5.12 billion by FY26, driven by rapid developments in online platforms and increased demand for quality content among users.

RECENT DEVELOPMENT/INVESTMENTS

- In March 2022, Pocket FM in India raised US$ 65 million and has plans to expand in new regional languages.

- In March 2022, Krafton infused US$ 19.5 million in Indian audio content platform Kuku FM.

- In November 2021, media consulting firm Ormax Media, launched an OTT Brand Health Tracking Tool called Ormax Brand Monitor (OBM). The tool is based on syndicated research conducted every month among SVOD & AVOD audiences across India, to track the performance of 16 OTT platforms on key brand measures.

- In November 2021, social gaming platform WinZO, with Kalaari Capital announced a new investment initiative, ‘Gaming Lab’, to encourage and support India’s gaming ecosystem.

- In November 2021, digital entertainment and technology company JetSynthesys, partnered with Mr. Sonu Nigam, an artiste, to launch the Indian music industry's first-ever NFT (Non-fungible token) series.

- In November 2021, media consulting firm Ormax Media, launched an OTT Brand Health Tracking Tool called Ormax Brand Monitor (OBM). The tool is based on syndicated research conducted every month among SVOD & AVOD audiences across India, to track the performance of 16 OTT platforms on key brand measures.

- In November 2021, The Viral Fever (TVF), a video on-demand and over-the-top streaming service, raised US$ 2 million in debt from Mumbai-based venture debt firm BlackSoil.

- In October 2021, Star & Disney India signed advertising deals worth ~Rs. 1,200 crore (US$ 160.16 million), for the ICC T20 World Cup, marking a three-time rise over the last tournament, which was held in 2016 in India.

- In October 2021, Toch.ai, a SaaS platform for the video content industry, raised US$ 11.75 million in Series A funding. Moneta Ventures, Baring Private Equity India, Mr. Binny Bansal, Ventureast, 9 Unicorns, Anthill Ventures, Cathexis Ventures, SOSV, Artesian and Innoven Capital participated in the funding round.

- In October 2021, Indian telecom major Bharti Airtel, launched its Video Platform as a Service (CPaaS)— ‘Airtel IQ Video’. The solution, developed by Airtel’s in-house engineering teams, will allow entertainment companies and broadcasters to offer OTT video services with minimal investment by leveraging Airtel’s video cloud platform.

- In October 2021, Times Network announced the launch of Times Now Navbharat — a Hindi news channel — and ET NOW Swadesh — a Hindi business news channel—in the US, Canada and key international markets, in partnership with Yupp TV.

- In the second quarter of 2021, smart TV shipments from India increased by 65% YoY, due to rising expansion activities adopted by original equipment manufacturers (OEMs) for their smart TV portfolios.

- In September 2021, Zee Entertainment Enterprises (ZEEL) announced a plan to merge with Sony Pictures Networks India. As part of this agreement, Sony plans to invest US$ 1.57 billion in the merged entity.

- In September 2021, Netflix India signed a multi-year agreement with Excel Entertainment to strengthen its original series share in India.

- In September 2021, Reliance Entertainment signed a 10-film agreement with T-Series at a transaction value of Rs. 1,000 crore (US$ 135.61 million).

- In July 2021, WinZO, a leading gaming and entertainment platform, secured US$ 6 million in a Series C investment round that was headed by Griffin Gaming Partners of California, bringing the company's total capital raised to US$ 90 million.

GOVERNMENT INITIATIVES

The Telecom Regulatory Authority of India (TRAI) is set to approach the Ministry of Information and Broadcasting, Government of India, with a request to Fastrack the recommendations on broadcasting, in an attempt to boost reforms in the broadcasting sector. The Government of India has agreed to set up National Centre of Excellence for Animation, Gaming, Visual Effects and Comics industry in Mumbai. The Indian and Canadian Government have signed an audio-visual co-production deal to enable producers from both the countries exchange and explore their culture and creativity, respectively.

In October 2021, Prasar Bharati decided to auction its archives with the hope of monetising the content through sale to television and OTT platforms.

In June 2021, the Union Ministry of Information and Broadcasting notified the Cable Television Network (Amendment) Rules, 2021, which aims to establish a three-layer statutory mechanism for citizens to raise grievances with respect to broadcasted content.

As part of the expansion to include all digital platforms and digital (OTT) players under a single roof, in May 2021, the Indian Broadcasting Foundation (IBF) announced the move to be renamed as the Indian Broadcasting and Digital Foundation (IBDF).

As per the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, IBDF would also form a self-regulatory body (SRB) soon.

To ease filming in railways, the Film Facilitation Office (FFO) set up in the National Film Development Corporation (NFDC) collaborated with the Ministry of Railways to develop an integrated single window filming mechanism to streamline the permission process for filming across railway premises.

In November 2021, the government announced that it is working towards creating a National Centre of Excellence for AVGC (animation, visual effects, gaming and comics).

On February 25, 2021, the government outlined the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules 2021 to establish a progressive institutional mechanism and a three-tier grievance redressal framework for news publishers and OTT platforms on the digital media.

In February 2021, the digital entertainment committee of the Internet and Mobile Association of India (IAMAI) finalised a code of conduct to form the basis for self-regulation code for OTT content. The code has been endorsed by 17 OTT platforms including Netflix, Amazon Prime Video, Disney+ Hotstar, ZEE5 and Voot.

In February 2021, Prasar Bharati (India) and PSM (the official State Media of Maldives) inked an agreement to facilitate collaboration and capacity building in the field of broadcasting.

Digital audio–visual content including films and web shows on over-the-top (OTT) streaming platforms, as well as news and current affairs on online platforms, have been brought under the Ministry of Information and Broadcasting in November 2020.

ROAD AHEAD

Indian M&E industry is on an impressive growth path. The industry is expected to grow at a much faster rate than the global average rate.

Growth is expected in retail advertisement on the back of several players entering the food and beverages segment, E-commerce gaining more popularity in the country, and domestic companies testing out the waters. Rural region is also a potentially profitable target.

Note: Conversion rate used for November 2021 is Rs. 1 = US$ 0.01336

References: Media Reports, Press Releases, Press Information Bureau, Department for Promotion of Industry and Internal Trade (DPIIT), Crisil report

Disclaimer: This information has been collected through secondary research and IBEF is not responsible for any errors in the same.

Media and Entertainment India

- Television

- Digital and OTT

- Films

- Animation, VFX and Post Production

- Gaming

- Out of Home

- Radio

- Music

Industry Contacts

- The Indian Newspaper Society

- Indian Motion Picture Producers’ Association (IMPPA)

- The Film and Television Producers Guild of India

- Newspapers Association of India (NAI)