INTRODUCTION

Fast-moving consumer goods (FMCG) sector is India’s fourth-largest sector with household and personal care accounting for 50% of FMCG sales in India. Growing awareness, easier access and changing lifestyles have been the key growth drivers for the sector. The urban segment (accounts for a revenue share of around 55%) is the largest contributor to the overall revenue generated by the FMCG sector in India. However, in the last few years, the FMCG market has grown at a faster pace in rural India compared to urban India. Semi-urban and rural segments are growing at a rapid pace and FMCG products account for 50% of the total rural spending.

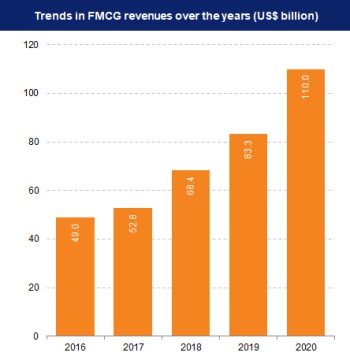

MARKET SIZE

The FMCG market in India is expected to increase at a CAGR of 14.9% to reach US$ 220 billion by 2025, from US$ 110 billion in 2020. The Indian FMCG industry grew by 16% in CY21 a 9-year high, despite nationwide lockdowns, supported by consumption-led growth and value expansion from higher product prices, particularly for staples. The rural market registered an increase of 14.6% in the same quarter and metro markets recorded positive growth after two quarters. Final consumption expenditure increased at a CAGR of 5.2% during 2015-20. According to Fitch Solutions, real household spending is projected to increase 9.1% YoY in 2021, after contracting >9.3% in 2020 due to economic impact of the pandemic. The FMCG sector's revenue growth will double from 5-6% in FY21 to 10-12% in FY22, according to CRISIL Ratings. Price increases across product categories will offset the impact of rising raw material prices, along with volume growth and resurgence in demand for discretionary items, are driving growth. The FMCG sector grew by 36.9% in the April-June quarter of 2021 despite lockdowns in various parts of the country.

Number of households shopping on modern-trade channel grew 29.15% YoY in the September quarter and shopping volume on the channel went up by 19.2% YoY.

In September 2021, rural consumption of FMCG increased 58.2% YoY; this is 2x more than the urban consumption (27.7%).

In the third quarter of FY20 in rural India, FMCG witnessed a double-digit growth recovery of 10.6% due to various government initiatives (such as packaged staples and hygiene categories); high agricultural produce, reverse migration, and a lower unemployment rate. Rise in rural consumption will drive the FMCG market. The Indian processed food market is projected to expand to US$ 470 billion by 2025, up from US$ 263 billion in 2019-20

FMCG giants such as Johnson & Johnson, Himalaya, Hindustan Unilever, ITC, Lakmé and other companies (that have dominated the Indian market for decades) are now competing with D2C-focused start-ups such as Mamaearth, The Moms Co., Bey Bee, Azah, Nua and Pee Safe. Market giants such as Revlon and Lotus took ~20 years to reach the Rs. 100 crore (US$ 13.4 million) revenue mark, while new-age D2C brands such as Mamaearth and Sugar took four and eight years, respectively, to achieve that milestone.

Companies with dedicated websites recorded an 88% YoY rise in consumer demand in 2020. Since then, more businesses have begun to adopt the D2C model, and India is now home to >800 D2C brands looking at a US$ 101 billion opportunity by 2025.

E-commerce companies reported sales worth US$ 9.2 billion across platforms in October and November (2021), driven by increased shopping during the festive season. With festive season sales, Flipkart Group emerged as the leader with a 62% market share.

Advertising volumes on television recorded healthy growth in the July-September quarter, registering 461 million seconds of advertising, which is the highest in 2021. FMCG continued to maintain its leadership position with 29% growth in ad volumes against the same period in 2019. Even the e-commerce sector showed a healthy 26% jump over 2020.

INVESTMENTS

The Government has allowed 100% Foreign Direct Investment (FDI) in food processing and single-brand retail and 51% in multi-brand retail. This would bolster employment, supply chain and high visibility for FMCG brands across organised retail markets thereby bolstering consumer spending and encouraging more product launches. The sector witnessed healthy FDI inflows of US$ 20.01 billion from April 2000-December 2021.

Some of the recent developments in the FMCG sector are as follows:

- In February 2022, Dabur India, formed an exclusive partnership with energy provider Indian Oil, which will give Dabur's products direct access to around 140 million Indane LPG consumer households across India.

- Beco, a startup in India, is revolutionising the FMCG market with low-cost, environmentally-friendly consumer goods.

- In February 2022, Dabur India achieved its goal to collect, process, and recycle approximately 22,000MT of post-consumer plastic three months early.

- In February 2022, Marico Ltd announced its aims to achieve net-zero emissions by 2040 in its global operations.

- In November 2021, Tata Consumer Products (TCPL) signed definitive agreements to acquire 100% equity shares of Tata SmartFoodz Limited (TSFL) from Tata Industries Limited for a cash consideration of Rs. 395 crore (US$ 53.13 million). This move was in line with TCPL's strategic intent to expand into the value-added categories.

- In November 2021, Unilever Plc agreed to sell its global tea business to CVC Capital Partners for EUR 4.5 billion (US$ 5.1 billion. The business being sold—Ekaterra—hosts a portfolio of 34 tea brands, including Lipton, PG Tips, Pukka Herbs and TAZO.

- In November 2021, McDonald's India partnered with an FMCG company ITC to add a differentiated fruit beverage, B Natural, to its Happy Meal, which will be available across all McDonald's restaurants in South and West India, primarily catering to children aged 3–12 years.

- In October 2021, Procter & Gamble announced an investment of Rs. 500 crore (US$ 66.8 million) in rural India.

- In September 2021, PepsiCo commissioned its Rs. 814 crore (US$ 109.56 million) Kosi Kalan foods facility in Mathura, Uttar Pradesh; it is the company's largest greenfield manufacturing investment in India.

- In September 2021, Vahdam India, an Indian tea brand, raised Rs. 174 crore (US$ 24 million) as part of its Series D round led by IIFL AMC's Private Equity Fund.

- In September 2021, RP-Sanjiv Goenka Group entered the personal-care segment by launching skin and haircare products, aiming at a revenue of Rs. 400-500 crore (US$ 53.84-67.30 million) in the next 4-5 years

- In September 2021, Adani Wilmar announced the opening of physical stores under the name 'Fortune Mart' that will exclusively sell Fortune and other Adani Wilmar brand products.

- In August 2021, Apnaklub, a Bengaluru-based B2B wholesale marketplace for consumer goods, raised US$ 3.5 million in a seed round from Sequoia Capital India's Surge, increasing the total funds to US$ 5 million.

- In August 2021, Soothe Healthcare, an Indian personal hygiene products brand, raised Rs. 130 crore (US$ 17.54 million) in a Series-C round of funding from A91 Partner Partners.

- In August, Adani Wilmar, a 50/50 joint venture between Adani Group and Singapore-based Wilmar, filed for initial public offering (IPO) to raise up to Rs. 4,500 crore (US$ 607.13 million) for expansion.

- In the fourth quarter of FY21, e-commerce sales of Marico Ltd., Hindustan Unilever Ltd., Dabur India, ITC and Godrej Consumer Products Ltd. were 8%, 6%, 5%, 5%, and 4%, respectively, of the total FMCG sales.

- In July 2021, Emami Ltd. increased its stake (by 15% to 46%) in Helios Lifestyle, which sells male-grooming products under The Man Company brand in line with its ambition to tap emerging online opportunities.

- In July 2021, Tata Consumer Products Ltd. introduced 'Eight O'Clock', America's Original Gourmet Coffee, under D2C, besides Tata Coffee 1868 and Sonnets, as a part of its strategy to enhance its D2C approach for select coffee brands and their specific websites. The company plans to add more brands in the D2C space as these three coffee brands stabilise.

- In July 2021, HUL launched in-store vending machine model, Smart Fill machine, for its home care products with the aim to reuse and recycle plastic. Smart Fill machine will allow consumers to reuse plastic bottles by refilling products from its brands like Surf Excel, Comfort and Vim.

- As of June 2021, e-commerce share has already touched 7-8% for some of the largest FMCG companies in the country, according to Accenture India.

- In June 2021, Dabur India announced its Rs. 550 crore (US$ 75.6 million) investment to set up a new plant in Madhya Pradesh for manufacturing of food products, ayurvedic medicines and health supplements.

- In May 2021, Tata Digital Ltd., a 100% subsidiary of Tata Sons, acquired a 64.3% stake in supermarket grocery supplies, the business-to-business arm of BigBasket in tandem with Tata Group's strategy to build a digital consumer ecosystem. According to the Economic Times, the deal is worth U$ 1.8-2 billion.

- In May 2021, Nepal-based CG Corp Global, known for its popular noodles brand Wai Wai, announced its plan to invest Rs. 200 crore (27.42 million) to set up two new manufacturing plants in West Bengal and Uttar Pradesh.

GOVERNMENT INITIATIVES

Some of the major initiatives taken by the Government to promote the FMCG sector in India are as follows:

- In November 2021, Flipkart signed an MoU with the Ministry of Rural Development of the Government of India (MoRD) for their ambitious Deendayal Antyodaya Yojana – National Rural Livelihood Mission (DAY-NRLM) programme to empower local businesses and self-help groups (SHGs) by bringing them into the e-commerce fold.

- Companies are counting on recent budget announcements like direct transfer of Rs. 2.37 lakh crore (US$ 30.93 billion) in minimum support payment (MSP) to wheat and paddy farmers and the integration of 150,000 post offices into the core banking system to expand their reach in rural India.

- On November 11, 2020, Union Cabinet approved the production-linked incentive (PLI) scheme in 10 key sectors (including electronics and white goods) to boost India's manufacturing capabilities, exports and promote the 'Atmanirbhar Bharat' initiative.

- Developments in the packaged food sector will contribute to increased prices for farmer and reduce the high levels of waste. In order to provide support through the PLI scheme, unique product lines—with high-growth potential and capabilities to generate medium- to large-scale jobs—have been established.

- The Government of India has approved 100% FDI in the cash and carry segment and in single-brand retail along with 51% FDI in multi-brand retail.

- The Government has drafted a new Consumer Protection Bill with special emphasis on setting up an extensive mechanism to ensure simple, speedy, accessible, affordable and timely delivery of justice to consumers.

- The Goods and Services Tax (GST) is beneficial for the FMCG industry as many of the FMCG products such as soap, toothpaste and hair oil now come under the 18% tax bracket against the previous rate of 23-24%. Also, GST on food products and hygiene products has been reduced to 0-5% and 12-18% respectively.

- GST is expected to transform logistics in the FMCG sector into a modern and efficient model as all major corporations are remodelling their operations into larger logistics and warehousing.

ROAD AHEAD

Rural consumption has increased, led by a combination of increasing income and higher aspiration levels. There is an increased demand for branded products in rural India.

On the other hand, with the share of unorganised market in the FMCG sector falling, the organised sector growth is expected to rise with increased level of brand consciousness, augmented by the growth in modern retail.

Another major factor propelling the demand for food services in India is the growing youth population, primarily in urban regions. India has a large base of young consumers who form majority of the workforce, and due to time constraints, barely get time for cooking.

Online portals are expected to play a key role for companies trying to enter the hinterlands. Internet has contributed in a big way, facilitating a cheaper and more convenient mode to increase a company’s reach. The number of internet users in India is likely to reach 1 billion by 2025. It is estimated that 40% of all FMCG consumption in India will be made online by 2020. The online FMCG market is forecast to reach US$ 45 billion in 2020 from US$ 20 billion in 2017.

It is estimated that India will gain US$ 15 billion a year by implementing GST. GST and demonetisation are expected to drive demand, both in the rural and urban areas, and economic growth in a structured manner in the long term and improved performance of companies within the sector.

References: Media Reports, Press Information Bureau (PIB), Firstpost

Disclaimer: This information has been collected through secondary research and IBEF is not responsible for any errors in the sam

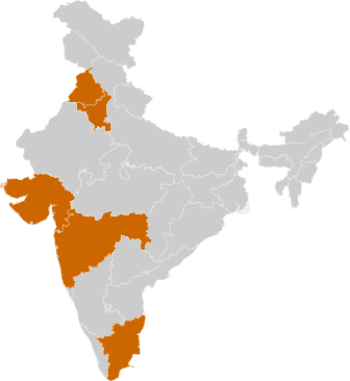

Major FMCG cities

- Chandigarh

- Maharashtra

- Tamil Nadu

- Gujarat

- Punjab

Industry Contacts

- Indian Dairy Association

- All India Bread Manufacturers’ Association

- All India Food Processors’ Association

- Indian soap and toiletries manufacturers’ association